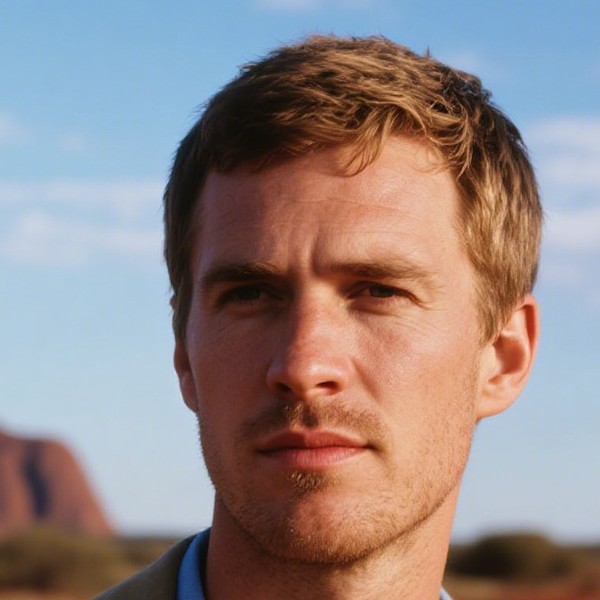

About James Mitchell

Financial Planner

Book a Meeting

Independent and Comprehensive Advice

James Mitchell has been engaged in the financial industry for many years, accumulating profound industry experience. He is proficient in various types of financial knowledge, and can provide clients with comprehensive and professional advice on everything from complex investment strategies and detailed retirement planning to risk management and tax planning. Mitchell is well aware that each client differs in terms of financial status, goals and risk tolerance. Therefore, he has always adhered to the concept of personalized service. Before formulating a plan, he will gain an in-depth understanding of the client's actual situation, including various factors such as income, assets, liabilities, family status, financial goals and risk preference, to ensure that an exclusive financial planning plan is created for each client.

15+

Years of Experience

Over a decade of experience in financial planning

Expertise Areas

We provide a full range of services

Qualifications and Associations

Tax Practitioner board

2021 – Current

Member of the Financial Advice Association Australian

2009 – Current

Advanced Diploma in Financial Planning

Pinnacle 2009

Graduate Diploma in Global Wealth Management

University of Adelaide 2008

Bachelor of Economics

University of Adelaide 2007

What Our Happy Clients Say

You can be our next success story!

Charlotte W.I am extremely impressed by the exceptional service and profound professional expertise provided by Liam from Vtap Wealth — this experience has completely reshaped my expectations of financial advisory services, and Vtap Wealth’s strengths shine through brilliantly at every stage of the service. From our very first meeting, Liam (and Vtap Wealth’s client-centric service philosophy) stood out: he didn’t rush to offer one-size-fits-all advice. Instead, he took the time to truly understand my unique financial goals — whether it was expanding investments, securing a stable retirement, or creating a reasonable budget. Shortly after, a financial plan tailored specifically to me came into being, rather than a generic, template-based product — and this is precisely Vtap Wealth’s primary core strength: they are always committed to providing personalized solutions, making you feel "valued" rather than just a client number.read moreread less

Charlotte W.I am extremely impressed by the exceptional service and profound professional expertise provided by Liam from Vtap Wealth — this experience has completely reshaped my expectations of financial advisory services, and Vtap Wealth’s strengths shine through brilliantly at every stage of the service. From our very first meeting, Liam (and Vtap Wealth’s client-centric service philosophy) stood out: he didn’t rush to offer one-size-fits-all advice. Instead, he took the time to truly understand my unique financial goals — whether it was expanding investments, securing a stable retirement, or creating a reasonable budget. Shortly after, a financial plan tailored specifically to me came into being, rather than a generic, template-based product — and this is precisely Vtap Wealth’s primary core strength: they are always committed to providing personalized solutions, making you feel "valued" rather than just a client number.read moreread less Liam X.We have been working with Oliver for years, and this long-term partnership has not only let us experience his extremely meticulous service attitude but also witnessed his consistently high professional standards — every piece of advice he provides is well-thought-out, which not only aligns with our financial needs but also takes long-term planning into account, making him completely trustworthy. From formulating the initial basic financial plan to later optimizing strategies based on changes in our family situation (such as adjustments in income and retirement planning), Oliver never overlooks any details: whether it is interpreting key data in an investment report (the smaller things) or controlling risks in the overall asset allocation (the bigger things), he handles each task with a rigorous attitude, ensuring we clearly understand the logic behind every decision. This meticulousness that "puts the client’s needs first" is the core reason we are willing to choose him for the long term.read moreread less

Liam X.We have been working with Oliver for years, and this long-term partnership has not only let us experience his extremely meticulous service attitude but also witnessed his consistently high professional standards — every piece of advice he provides is well-thought-out, which not only aligns with our financial needs but also takes long-term planning into account, making him completely trustworthy. From formulating the initial basic financial plan to later optimizing strategies based on changes in our family situation (such as adjustments in income and retirement planning), Oliver never overlooks any details: whether it is interpreting key data in an investment report (the smaller things) or controlling risks in the overall asset allocation (the bigger things), he handles each task with a rigorous attitude, ensuring we clearly understand the logic behind every decision. This meticulousness that "puts the client’s needs first" is the core reason we are willing to choose him for the long term.read moreread less Grace Y.Before each communication, the company always sorts out our financial status in advance. It even takes the initiative to flag details we might overlook and presents the analysis results in clear tables or charts, sparing us from having to repeatedly verify information amid a jumble of data.read moreread less

Grace Y.Before each communication, the company always sorts out our financial status in advance. It even takes the initiative to flag details we might overlook and presents the analysis results in clear tables or charts, sparing us from having to repeatedly verify information amid a jumble of data.read moreread less David W.A big thank you to the entire team! Since my first meeting at their office, their advice has always been spot-on—consistently based on easy-to-understand and practical financial logic. I’ve never felt more confident about my investments, and I would never trust anyone else with my long-term financial planning.read moreread less

David W.A big thank you to the entire team! Since my first meeting at their office, their advice has always been spot-on—consistently based on easy-to-understand and practical financial logic. I’ve never felt more confident about my investments, and I would never trust anyone else with my long-term financial planning.read moreread less Sarah J.For years, this has been our top choice for a financial partner. Their office always has a comfortable and welcoming vibe, making it perfect for discussing our financial goals. With their help, we made a smooth transition into retirement, and our superannuation has grown far beyond our expectations thanks to their tailored recommendations. Having such a professional team supporting us gives us great peace of mind.read moreread less

Sarah J.For years, this has been our top choice for a financial partner. Their office always has a comfortable and welcoming vibe, making it perfect for discussing our financial goals. With their help, we made a smooth transition into retirement, and our superannuation has grown far beyond our expectations thanks to their tailored recommendations. Having such a professional team supporting us gives us great peace of mind.read moreread less Thomas B.Our partnership started with our first visit to their office. From day one of working together, their team has been transparent and professional when it comes to our finances. They take the time to explain every investment option in plain language and never rush us into making decisions. Now as long-term clients, we’re constantly impressed by their commitment to putting clients’ needs first—we couldn’t be more satisfied with their services.read moreread less

Thomas B.Our partnership started with our first visit to their office. From day one of working together, their team has been transparent and professional when it comes to our finances. They take the time to explain every investment option in plain language and never rush us into making decisions. Now as long-term clients, we’re constantly impressed by their commitment to putting clients’ needs first—we couldn’t be more satisfied with their services.read moreread less Jessica L.If you’re looking for a financial firm that truly cares about your future, this is the perfect choice. Their office is conveniently located, and the team members have decades of industry experience. They break down complex financial strategies into easy-to-understand terms, so you always know exactly what’s happening with your money. We’ve recommended this place to friends and family, and everyone has had the same great experience—they’re truly among the best in the industry.read moreread less

Jessica L.If you’re looking for a financial firm that truly cares about your future, this is the perfect choice. Their office is conveniently located, and the team members have decades of industry experience. They break down complex financial strategies into easy-to-understand terms, so you always know exactly what’s happening with your money. We’ve recommended this place to friends and family, and everyone has had the same great experience—they’re truly among the best in the industry.read moreread less Andrew M.Harry has been looking after my wife and my financial affairs for many years. He is a consummate professional and has assisted our super growth in since rolling it over after retirement.

Andrew M.Harry has been looking after my wife and my financial affairs for many years. He is a consummate professional and has assisted our super growth in since rolling it over after retirement.

He is thorough and fees are very competitive. He regularly organises meetings with us at our residence which we find much easier than heading into town.

I can ,with hand on heart ,thoroughly recommend Harry to anyone looking for a long term professional financial planner .read moreread less Rebecca K.I’ve been a client here for years, and their office has become a familiar place where I always feel completely at ease discussing my finances. Their team never uses jargon to confuse people; instead, they explain every recommendation clearly, and after each meeting, they provide me with a detailed Record of Advice for future reference. My financial goals have always been met on schedule, and compared to the high-quality service they provide, their annual advisory fee is quite reasonable. For anyone looking for a reliable and professional financial partner, I wouldn’t hesitate to recommend this place.read moreread less

Rebecca K.I’ve been a client here for years, and their office has become a familiar place where I always feel completely at ease discussing my finances. Their team never uses jargon to confuse people; instead, they explain every recommendation clearly, and after each meeting, they provide me with a detailed Record of Advice for future reference. My financial goals have always been met on schedule, and compared to the high-quality service they provide, their annual advisory fee is quite reasonable. For anyone looking for a reliable and professional financial partner, I wouldn’t hesitate to recommend this place.read moreread less

Comprehensive financial advice for

Self-Funded Retirees

A self-funded retiree is someone who has accumulated enough personal wealth and savings to sustain themselves financially during retirement, independent of government pensions or welfare benefits. Achieving this status often requires meticulous financial planning and management to ensure that assets and income streams are sufficient for a comfortable and sustainable retirement.

- Retirement Planning

- Tax Planning

- Portfolio Management

- Estate Planning

- Superannuation/SMSF

- Ongoing Bespoke Service

Families

Family financial planning is a comprehensive approach to managing resources, extending beyond daily budgeting to incorporate long-term strategies. This includes considerations for retirement, real estate investments, and other long-term financial goals, aiming to build a strong financial foundation for parents and ensure ongoing security for their children.

- Financial Goal Setting and Strategy Development

- Budgeting and Cashflow Management

- Life Insurance

- Superannuation (including SMSF)

- Tax Planning

- Debt Management

- Investment Planning

- Children's Education

- Estate Planning

- Financial Education

Business Owners

Financial planning for business owners involves crafting strategies to manage both business and personal finances effectively. This ensures the business’s financial health while also addressing the owner’s personal financial objectives.

- Business Goal Setting and Strategy Development

- Risk Management and Business Insurance (Key Man/Buy Sell)

- Estate Planning

- Portfolio Management

- Cashflow Management

- Investment Planning

- Debt Management

- Tax Planning & Strategy

- Superannuation (including SMSF)

- Retirement Planning

- Ongoing Bespoke Service

Professionals

Financial planning for professionals involves creating customized financial strategies that cater to the unique needs and challenges of those in specialized careers. Given their high earning potential and complex tax situations, professionals require tailored solutions to achieve long-term financial success and security.

- Financial Goal Setting and Strategy Development

- Tax Strategy & Planning

- Portfolio Management

- Life Insurance

- Investment Planning

- Debt Management

- Estate Planning

- Superannuation Advice (including SMSF)

- Ongoing Bespoke Service

Financially Ambitious Individuals

For those with high financial aspirations, strategic planning is crucial to achieving their goals. Partnering with Vtap Wealth allows financially ambitious individuals to develop and execute a customized financial strategy that aligns with their aspirations, ensuring they reach their objectives and secure their financial future.

- Financial Goal Setting and Strategy Development

- Advanced Investment Planning

- Tax Planning & Strategy Support

- Debt Management and Gearing Strategies

- Superannuation (including SMSF)

- Life Insurance

- Estate Planning

- Ongoing Bespoke Service

Our Expertise

We're not your usual financial advisors

We tailor our strategies to each client, recognising that every client is unique.

Advice you can trust

There are lots of financial advisers out there but we’re proud to say there are not many like us. Not everyone subscribes to the highest ethical and professional standards.